A completed Free Application for Federal Student Aid (FAFSA) is the starting point for financial assistance.

A variety of federal, state and institutional programs for those who demonstrate a financial need, including grants, scholarships, loans, and work-study jobs, but there may be other financial assistance programs available that require additional applications. We also offer a Payment Plan option that all students may use. The only financial aid application we need to determine aid eligibility is the FAFSA.

- Fall 2025 - Submit your 2025-26 FAFSA at studentaid.gov/h/apply-for-aid/fafsa.

The earlier you complete your FAFSA, the better your chances of receiving financial assistance.

Notice: The State Board for Virginia’s Community Colleges voted May 22 to set tuition and mandatory educational and general (E&G) fees for the academic year that begins with the Fall 2025 semester. More information about the new tuition & fees can be found on the vccs.edu blog.

Important Financial Aid Links

- Interested in working on campus as a student worker? Click the link to see if you are eligible for a work study position!

- If you are interested in STEM or Health Care related programs, click here to learn more about Virginia’s Tuition Free G3 program.

- To review your financial aid award(s), log in to the Student Information System (SIS) and select the appropriate academic year.

What's Available?

There are grants, scholarships, loans, and work-study programs offered to help you meet your college goals. Browse the information provided in this section to help you determine the best option(s) for you.

For those interested in transferring, there is also the:

Transfer Grant Program (CTG)

Virginia’s Two-Year College Transfer Grant Program (CTG) allows qualifying students who complete their associate degree at a Virginia two-year public college and then transfer to a participating Virginia four-year college or university to receive up to $3,000 annually. Find the application and Fact Sheet on the SCHEV Transfer Grant webpage.

Students must have an associate degree with a 3.0 grade-point-average and meet financial eligibility requirements. The grant will be applied to tuition expenses at a four-year Virginia college or university, either public or private. (The grant provides $1,000 for all eligible students, with an extra $1,000 for students who pursue undergraduate work in engineering, mathematics, technology, nursing, teaching or science. An additional $1,000 can be earned for students who transfer to Norfolk State University, Old Dominion University, Radford University, University of Virginia – College at Wise, Virginia Commonwealth University, or Virginia State University.)

For more information, read the Transfer Planning page.

For those who do not qualify for federal student aid, there is also the:

The Virginia Alternative State Aid (VASA)

The Virginia Alternative State Aid (VASA) Application is an alternative option to the Free Application for Federal Student Aid (FAFSA).

Who should file a VASA Application?

Virginians who are nonimmigrants, undocumented, have Deferred Action for Childhood Arrivals (DACA) status or are otherwise ineligible to file the FAFSA and want to be considered for state financial aid. Note: Students must meet domicile or Tuition Equity Provision requirements.

Students who complete the VASA will not be eligible for federal grants, loans, or work-study, they can be considered for state grants.

The VASA Application is provided by the State Council of Higher Education for Virginia to enable certain students to apply for state financial aid as authorized under § 23.1-505.1. of the Code of Virginia.

Completing your FAFSA

Before beginning your online FAFSA, you must be admitted to CVCC in a financial aid eligible program of study.

- If you have questions about your application and/or your program of study, please contact Advising Services.

Your financial aid award cannot be determined until your Free Application for Federal Student Aid (FAFSA) has been completed. Before you apply online, create a FSA ID that lets you sign your FAFSA application electronically.

With these items complete, access the online FAFSA application. When prompted for CVCC's federal school code, enter 004988.

- If you are under 24 years of age, you may need a parent or guardian to help complete the application.

- Additional documentation may be required after submission of your FAFSA. Requests for these documents will be displayed in your To-Do-List within our Student Information System (SIS). Please log into your SIS and check your To-Do-List.

Your FAFSA is not complete if requested documentation is not submitted to the Financial Aid Office.

Note: Students who are interested in applying for a Federal Stafford Student Loan should also complete and submit a loan request form available in the Financial Aid Office.

The earlier you complete your no-cost FAFSA, the sooner you’ll know if you are eligible for financial aid.

If you are planning to enroll Fall 2025 or Spring 2026, you will submit the 2025-26 FAFSA.

Steps To Apply for Financial Aid

Step 1. Complete an admission/re-admission application to the college. Please include your Social Security Number for financial aid purposes. Choose a program of study that is financial aid eligible (if unsure contact Advising Services).

Step 2. Go to https://studentaid.gov/fsa-id/create-account/launch and request an FSA ID, this username and password lets you sign your FAFSA application electronically. If you are a dependent student, your parent should also request an FSA ID to sign your FAFSA.

Step 3. Go to www.fafsa.gov and complete a FAFSA for the upcoming year if you are starting in the fall. The federal school code for Central Virginia Community College is 004988. If you are under 24 years of age, then you may need a parent to help complete the process. Submitting the FAFSA does not mean you have completed the FAFSA. The Financial Aid Office may need additional documents from you in order to finalize your financial aid. If you have difficulties completing the FAFSA, representatives are available toll free at 1-800-433-3243 to help.

- If eligible, you should use the IRS Data Retrieval Tool to import federal income tax information from the IRS into your FAFSA.

- If not eligible to use the IRS Data Retrieval Tool, use copies of the family’s Federal Income Tax Return(s) from the year two years prior to the year you will enroll for the Fall of the academic year (for example, if you are enrolling in the 2024/2025 academic year, you would use your 2022 Federal Income Tax Return), to fill out the financial section of the FAFSA. If you do not have a copy of your federal tax return, you may call the IRS at 800-829-1040, visit www.irs.gov, visit your local IRS office, or fill out a 4506-T form to have a Tax Return Transcript mailed to you.

- Non-taxable income such as social security benefits, child support, etc., will also need to be input on your FAFSA application.

Step 4. If the federal government selects you for verification, you will be notified via the Message Center in your SIS account. Check your To-Do List by logging into the Student Information System (SIS). Submit any additional documents needed to the Financial Aid Office.

Step 5. Review your financial aid award notification. You will be notified via email and text as well as your myCVCC Message Center when you have been awarded.

Notes:

Additional types of financial aid may require additional forms be submitted to the Financial Aid Office.

Students who are interested in applying for a Federal Direct Student Loan should also follow instructions and submit a Loan Request Form in the Financial Aid Forms.

How to See Your Financial Aid Award

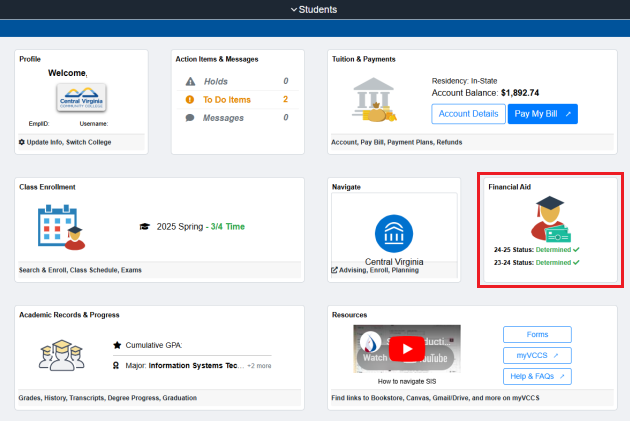

Step 1: Log into your myCVCC account.

Step 2: Click on SIS.

Step 3: Click on the “Financial Aid” box.

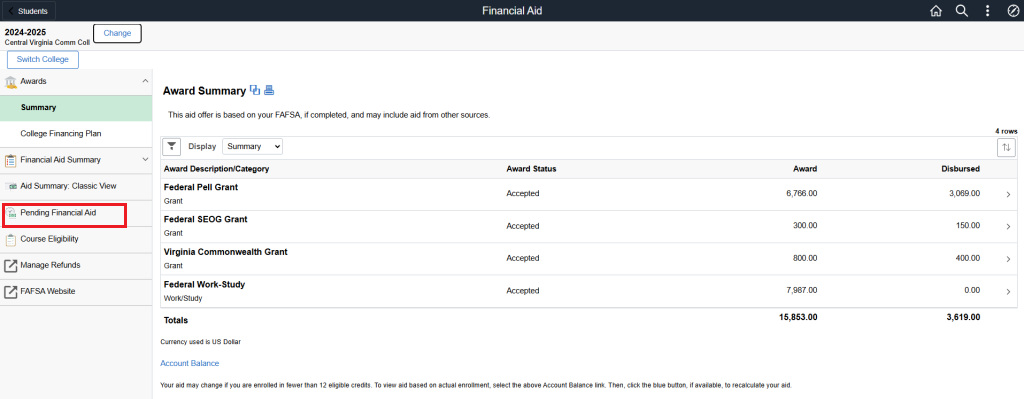

Step 4: To the left of the screen, find “Pending Financial Aid”, and click that.

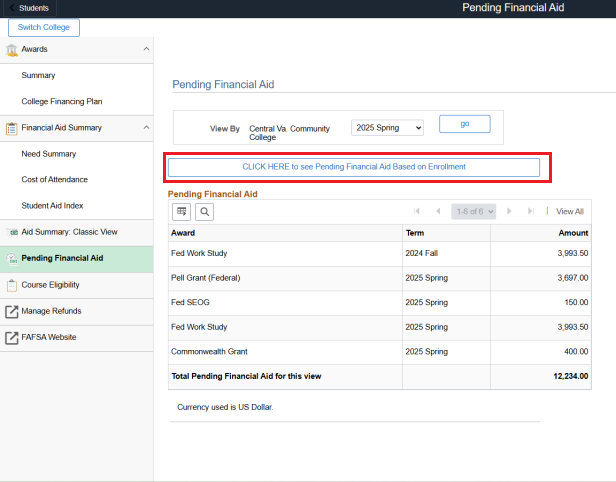

Step 5: This page is going to show you what your TOTAL POTENTIAL award amount would be for the academic year you are in currently if you were enrolled in 12 credits (full time). Make sure the dropdown box has the semester selected that you want to check the awards for. To see what your ACTUAL award amount is, click the link surrounded by red in the image – “CLICK HERE to see Pending Financial Aid Based on Enrollment”.

Step 6: The next page will show you the amounts you have actually been awarded for the semester based on your enrollment (number of credits). Compare that with the amount due on your balance, and you will know if you are going to have extra aid to use in the bookstore, or if you are going to owe.

Central Virginia Community College is required to provide the following information according to federal regulation [34 CFR 668.41]. All recipients or prospective recipients of federal aid must have a thorough understanding of the information shared below.

General Institutional Information

Refund Policy

Requirements for Withdrawal

Academic Program Pathways

Accreditation, Student Achievement and Classification of Instructional Programs

Graduation, Retention & Transfer Rates (SCHEV data)

Facilities and Services for Students with Disabilities

Faculty and Staff Directory

International Students

Distance Education

Transfer Information

Net Price Calculator

Bookstore Information

Course Offerings

Privacy of Student Records – Family Educational Rights and Privacy Act (FERPA)

Career Services

Facilities Management

Copyright and Computer Acceptable Use

Health & Safety

Substance Abuse Policy

Sexual Misconduct

Title IX

Campus Safety and Police

Emergencies and Alerts (Omnilert)

Annual Safety Report (Clery Act)

Threat Assessment Team (TAT)

Student Financial Assistance

Grants and Scholarships

Student Loans

Work-study Opportunities

Satisfactory Academic Progress (SAP) Policy

Entrance Counseling for Student Borrowers

Exit Counseling for Student Borrowers

Cost of Attendance

Returning Title IV Grant or Loan Assistance

Important Financial Aid Dates

Financial Aid Office Contact Information

Rights and Responsibilities of Financial Aid Recipients

Basic Criteria for Financial Aid Eligibility

FA Disbursement (includes info on methods and frequency of disbursements)

Loan Disbursement Frequency Information

Applying for Financial Aid

Federal Student Financial Aid Penalties for Drug Related Law Violations

CVCC Statistics (overall data for CVCC, cohort default rate, graduation rates, average net price, etc.)

When are financial aid balance checks mailed?

Financial Aid Awards (minus appropriate tuition and textbook charges) will be sent out approximately six weeks after all your classes have begun for the semester. Financial Aid refund balances will be sent by the method you choose at by logging into and following steps below.

- Go to www.centralvirginia.edu

- Log in to your myCVCC student account

- Select SIS (Student Information System)

- Select My Student Information

- Under Student Center – scroll to Finances section

- Select Manage Refunds

What is the census date?

The census date of a given semester is the last day to drop classes on the regular session. For example, for the fall and spring terms, the census date is always the last day to drop with a refund for the 16-week classes. For the summer term, the census date is always the last day to drop with a refund for the 10-week classes.

Are all classes eligible for financial aid?

No, some classes are not eligible for financial assistance such as ASL101-262, COS 81-82, REA 100, RVH 195. EMS courses are only covered by financial aid if the student is enrolled in the EMT-Intermediate or EMS Paramedic programs.

What other sources of aid are available?

There are many local, state and national organizations that grant scholarship funds each year. Check out the different types of financial aid available through CVCC.

Who has access to the information on the forms filed as part of the financial aid application?

Only the financial aid office staff at CVCC has access to this confidential information.

If my parents are separated/divorced, do they both have to contribute to my education?

For federal student aid (Pell grant, SEOG, and work-study), the custodial parent and current spouse, if any, must complete the FAFSA. The non-custodial parent is not required to report information for federal student aid purposes.

How do I become an independent student for federal aid purposes?

If you meet one of the following: are 24 years old, are a veteran of the U.S. Armed Forces, are married, are a ward of the court, have no living parents and have no legal guardian, or have a legal dependent who gets more than half of their support from you. The Free Application for Federal Student Aid (FAFSA) has more details about these categories.

What is my Student Aid Index (SAI)?

The Student Aid Index (SAI) helps your school determine how much financial support you may need. You receive an SAI based on the processing results of your Free Application for Federal Student Aid (FAFSA).

What if I have a credit balance on my student account?

If you have a credit balance in your account (after tuition and, if applicable, textbook charges have been paid) you will receive a refund approximately 6 weeks into the semester.

How do I get a work-study job?

You must first complete a FAFSA form. If you are interested, check our Work-Study page for more details and the form. Once all current positions are filled, we will start a waiting list. Students often drop or change jobs during the year; thus vacancies may arise.

When and how do I get paid for my student job?

You will be paid every two weeks for the hours that you work. It is your money to spend as you see fit on your education related expenses.

Do I have to work if I am given a job as part of my financial aid package?

No, the job is an opportunity to earn money to pay for ongoing personal and book expenses during the year. You can decide not to work and pay for these expenses some other way, such as through summer job earnings or work during vacation periods.

When do I apply for Summer Work-Study?

Notify the Financial Aid Office during the first week of March if you are interested in summer work-study. You must have financial need as defined by the Federal need analysis methodology, which is applied to the information provided on the Free Application for Federal Student Aid (FAFSA).

Will I have to pay back any financial aid money if I drop out or withdraw from school?

If you receive federal financial aid and drop out or withdraw from school during the first 60% of the semester you may be required to repay a percentage of the aid that you received.

Will my financial aid award be reviewed while I am at CVCC?

Each year you will be asked to re-apply for aid by completing the current FAFSA form so that changes in your family’s financial situation and changes in CVCC’s fees can be considered.

How do I apply for a Pell grant?

When you complete a FAFSA, you are automatically considered for a Pell grant.

Why did my financial need change from last year?

Since need represents the difference between total costs of attending CVCC and the ability of you and your family to contribute; any change in your family’s situation or in CVCC’s charges may mean a change in need.

What is the difference between the Student Financial Services Office and the Office of Student Financial Aid Services?

These two offices are located in different locations and are separate from one another administratively. The Office of Student Financial Aid Services awards grants, loans, and work-study. The Student Financial Services Office sends bills and collects payments for college charges not covered by aid. The Student Financial Services Office also mails your financial aid balance checks to you.

If my or my family’s current year income is drastically lower than what is indicated on my FAFSA, what do I do?

Contact the Financial Aid Office and request an Unusual and Special Circumstances Form. Complete and submit the form, along with the appropriate documentation, to the Financial Aid Office for consideration. Often projected yearly income can be considered. These considerations are made at the family’s request and on a case-by-case basis.

What is CVCC’s Title IV Code?

Our Title IV School Code is 004988.

If I have corrections that need to be made to my Student Aid Report, can I bring the forms into the Financial Aid Office for electronic submission?

Yes, make all the necessary corrections and make sure you have the required signatures on Part 2 of your SAR. Drop off your SAR and we will submit the corrections electronically. We normally receive the corrections back in about a week. It is also a good idea to submit copies of your tax returns to our office so that we may verify the corrections.

What is my Data Release Number (DRN)?

Your Data Release Number is a four-digit number assigned to your application by the U.S. Department of Education and printed on the top right corner of your Student Aid Report (SAR). Anyone wanting to receive or change your FAFSA information must have your DRN in order to do so. Do not give out your DRN to anyone unless you have agreed to give him or her access to your FAFSA information.

What is a FSA ID?

A FSA ID is the username and password that you need to:

- Sign your FAFSA electronically.

- Retrieve your Renewal FAFSA information over the Internet.

- File your Renewal FAFSA using the FAFSA on the Web site.

- Access the National Student Loan Data System (NSLDS) web site.

- and view information about other federal student aid you may have received.

Your FSA ID is similar to the login info you use to access your email accounts. To protect the privacy of the information you are submitting, you must keep your FSA password secret. If you need a FSA ID, have lost or forgotten your FSA ID, or if you think someone else knows your FSA ID, you can request a new one on the FAFSA log in page.

Some types of financial aid are eligible for refunds if the awarded aid exceeds any charges to the student’s account. These charges can include tuition, fees, bookstore charges, library charges, and/or any other outstanding student balance. Once these charges are paid, if there is an overage, the student will be refunded the difference.

When will financial aid be disbursed to student SIS accounts:

Financial aid is disbursed onto student accounts at various dates throughout each semester. The initial disbursement will happen AFTER the census date (last date to drop to receive a tuition refund) listed on the academic calendar.

- Fall/Spring semester - 16-week census date

- Summer semester - 10-week census date

Depending on the enrollment of 2nd 8-week classes, 2nd 5-week classes, or Dynamic classes, some students will not have financial aid disbursements until LATER in the semester.

- Fall/Spring semester – After the 2nd 8-week census date

- Summer semester – After the 2nd 5-week census date

If you made a payment to your student account or enrolled in a payment plan and received a financial aid award, you will be refunded for any amount that exceeds your charges. This will occur once financial aid is disbursed onto your student account.

If you have any questions about when your financial aid will disburse, please contact the financial aid office at 434-832-7814 or financialaid@centralvirginia.edu.

How will refunds be processed/sent:

Once the financial aid department disburses student aid, the accounting office will begin processing refunds. This is a multi-step process that can take up to 2 weeks to complete.

Refunds can be received by 2 methods:

- Direct Deposit (recommended). Sign up to have your financial aid refund deposited into your checking or savings account.

- Go to www.centralvirginia.edu

- Log into your myCVCC student account

- Select SIS (Student Information System)

- Tuition & Payments section, select Account Details

- Select Manage Refunds

- You will be directed to Nelnet Campus Commerce to enter your banking information. It is the responsibility of the student to keep account information current.

- Check (default if direct deposit is not set)

- A check will be mailed by Nelnet Campus Commerce (not CVCC) to the address listed in the student’s CVCC SIS account.

- It is the responsibility of the student to keep mailing information current.

If you have any questions regarding your refund, please contact the accounting office at 434-832-7639 or accounting@centralvirginia.edu.